📋 Table of Contents

- 1.Why is Tax Filing Important for Foreigners in Korea?

- 2.Resident or Non-Resident: What’s Your Tax Status?

- 3.Comprehensive Income Tax: What to File and When

- 4.Easy Steps to File Your Taxes in Korea

- 5.Year-End Tax Settlement for Foreign Employees

- 6.Special Tax Benefits for Foreign Workers

- 7.Preparing Your Documents for Tax Season

- 8.Planning to Leave Korea? Don’t Forget Your Taxes!

Hello everyone! 😊 Are you a foreigner living and earning money in Korea? If so, you might be wondering, “How do I deal with taxes here?” It can seem a bit confusing at first, but don’t worry, I’m here to help you understand all about foreigner Korea tax filing!

Just like Korean citizens, foreigners who earn income in Korea also need to report their earnings and pay taxes. The process, including how much tax you pay and how you file, can be different depending on things like whether you’re a resident or non-resident, and what kind of income you have. So, it’s really important to get it right! Let’s learn together about Korea income tax for foreigners.

Why is Tax Filing Important for Foreigners in Korea?

A person confidently managing their finances, symbolizing the importance of tax compliance.

If you’re earning money in Korea, whether from a job, a business, or even renting out a property, you have a responsibility to file your taxes. This is true for everyone, including foreigners!

Filing your taxes correctly isn’t just about following the law; it also helps you avoid any problems later on. Plus, sometimes you might even get money back! Understanding your foreigner Korea tax filing duties is the first step to a smooth financial life here.

Tax laws can be tricky, but knowing the basics will make everything much easier for you. Don’t be scared to ask for help if you’re unsure about anything!

Resident or Non-Resident: What’s Your Tax Status?

One of the biggest things to figure out for Korea income tax for foreigners is whether you are a ‘resident’ or a ‘non-resident’ for tax purposes. This makes a big difference in what income you need to report and what deductions you can get.

So, how do you know which one you are? It’s pretty simple:

Understanding Your Tax Status 📝

- Resident: If you have a permanent address in Korea or have lived here for 183 days or more in a year. As a resident, you must report ALL your income, both from Korea and from other countries.

- Non-Resident: If you don’t have a permanent address or haven’t lived in Korea for 183 days. As a non-resident, you only need to report income earned from sources within Korea.

Your status affects your tax deductions, tax rates, and even the types of income you need to declare. Making sure you know your correct status is the first crucial step in your foreigner tax resident Korea journey!

Comprehensive Income Tax: What to File and When

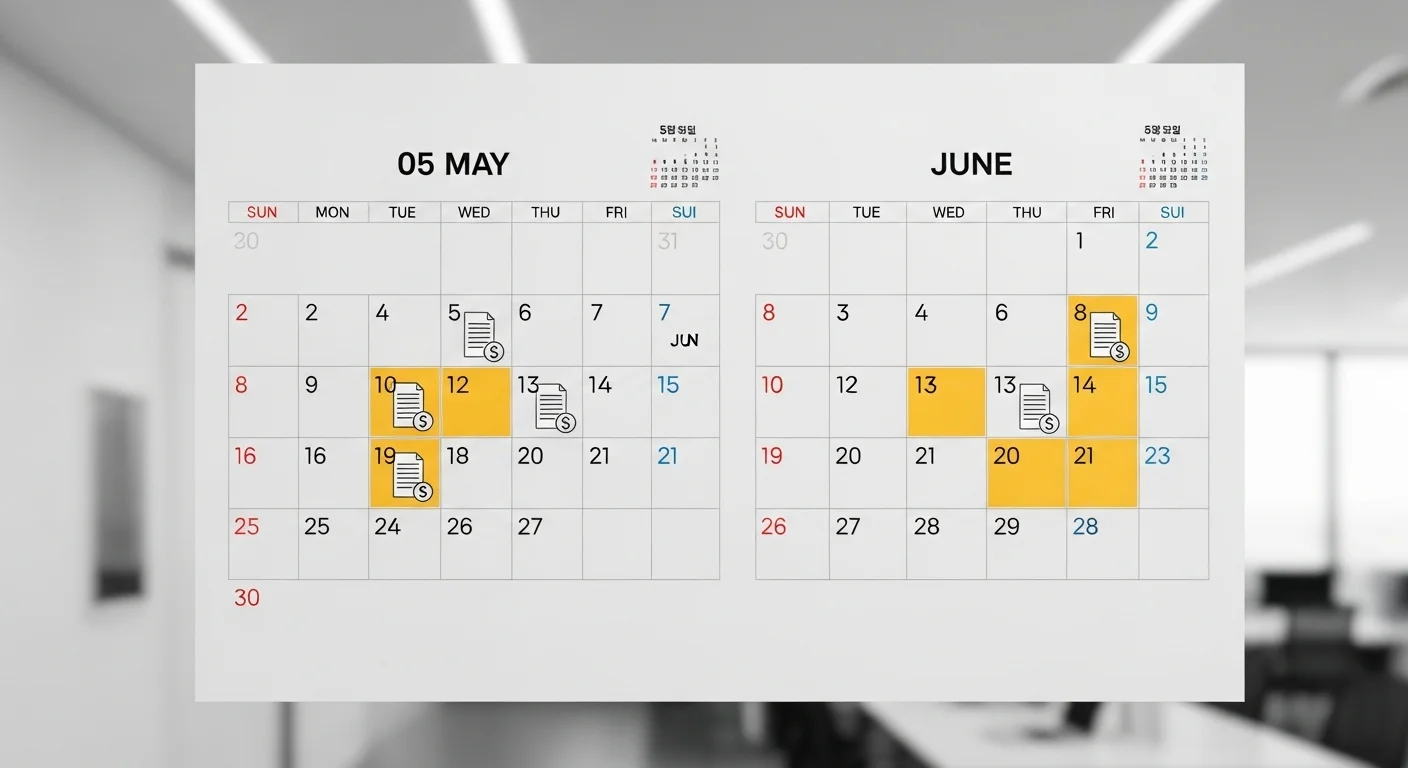

A calendar showing important tax filing dates for comprehensive income tax.

Even as a foreigner, if you have different types of income like salary, business profits, or rental income, you must file Comprehensive Income Tax. This combines all your income sources into one big report.

The tax filing period for 2025 is usually from May 1st to June 2nd. If you submit a “Sincere Filing Confirmation Document,” you might get an extension until June 30th. Make sure you don’t miss these important dates!

Who Needs to File? 📝

- Foreigners with income from:

- Employment (if not fully covered by Year-End Tax Settlement)

- Business activities

- Rental properties

- Other various sources

Staying on top of these deadlines is key for proper Korean tax return for expats. You can find more detailed information on the official National Tax Service (NTS) website: NTS Comprehensive Income Tax Guide.

Easy Steps to File Your Taxes in Korea

Filing your taxes might sound difficult, but Korea offers convenient ways to do it! You can choose between online filing or paper filing.

How to File Your Taxes 📝

- Online Filing: This is the easiest way! You can do it through the National Tax Service’s Hometax website (www.hometax.go.kr) or the SonTax mobile app. You’ll need to register using your Alien Registration Number.

- Paper Filing: If you prefer, you can visit a tax office in person or mail your documents.

- Tax Agent: If your situation is complicated, you can hire a tax agent to help you. They are professionals who can handle all the foreigner Korea tax filing for you.

Using the Hometax system is very common, and it’s designed to make tax filing simpler. Don’t be afraid to give it a try! If you’re looking for more guidance, you can also check out this helpful article: Tax Filing for Foreigners Without Resident ID (bznav).

Year-End Tax Settlement for Foreign Employees

A foreign employee looking at tax documents with a calm expression.

If you’re a foreign employee, you’re usually part of the Year-End Tax Settlement, just like Korean employees. This process happens around February each year.

For the income earned in 2024, you’ll need to submit your documents to your company by the end of February 2025. This helps ensure your expat tax guide Korea is followed correctly. Casual daily workers are generally excluded from this process.

After the Year-End Tax Settlement, you might either owe more taxes or get a refund. It’s like a final check to make sure you paid the right amount! You can learn more about it here: Year-End Tax Settlement for Foreign Workers 2025.

Special Tax Benefits for Foreign Workers

Good news! Foreign workers in Korea can sometimes get special tax benefits. These can help reduce the amount of tax you pay, making your 2025 Korea tax filing a bit easier.

Here are some notable benefits:

Special Tax Rates & Reductions 💡

- Flat Tax Rate (19%): Foreign employees can choose to apply a 19% flat tax rate on their income for up to 20 years, starting from their first year of employment in Korea.

- Tax Reduction for Engineers: Some foreign engineers may qualify for a 50% income tax reduction for the first 10 years.

However, it’s important to know that if you choose the 19% flat tax rate, some non-taxable benefits and deductions under the Income Tax Act might not apply to you. Always check which option is best for your situation!

You can find more details about tax reductions for foreign engineers here: Tax Reduction for Foreign Engineers (BizInfo).

Preparing Your Documents for Tax Season

To make your foreigner Korea tax filing process smooth, you’ll need to gather some important documents. It’s like preparing your backpack before a big trip!

Here’s a list of what you’ll typically need:

Essential Documents Checklist ✅

- Alien Registration Card (or Domestic Residence Report Card)

- Statement of Income

- Proof of various deductions (e.g., medical expenses, education fees, insurance premiums)

- Proof of income from Korea and overseas

If you agree to the Hometax simplified data provision service by January 15th, your company can easily view your necessary documents. This makes the expat tax guide Korea much simpler! For a full breakdown, check this resource: Foreign Worker Year-End Tax Settlement Guide (iQuest).

Planning to Leave Korea? Don’t Forget Your Taxes!

If you’re a foreigner living in Korea and planning to leave, there’s one last important thing to remember: your taxes! You need to file your income tax before you leave the country.

If you’re a resident and you’re leaving, you must report your income earned from January 1st until the day before your departure. If you don’t, you could face penalties. Even if you change to non-resident status, you still need to report income earned from Korean sources.

Failing to file your taxes before leaving can cause problems if you ever plan to return to Korea or deal with financial matters here again. Always make sure your foreigner Korea tax filing is complete!

It’s always best to settle everything properly. If you’re an expat and need to transfer money from Korea before leaving, you might find this guide helpful: Transfer Money from Korea: Your 2025 Easy Guide.

📚 Recommended Reads

Key Takeaways for Foreigner Korea Tax Filing 📝

Let’s quickly recap the most important points about foreigner Korea tax filing:

- Tax Obligation: All foreigners earning income in Korea must file taxes, just like citizens.

- Resident Status: Your tax obligations differ greatly based on whether you are a ‘resident’ (183+ days in Korea) or ‘non-resident’.

- Filing Period: Comprehensive Income Tax for 2025 is typically from May 1st to June 2nd. Don’t miss it!

- Methods: You can file online via Hometax or in person/mail. Consider a tax agent for complex cases.

- Special Benefits: Some foreigners, especially new employees or engineers, can benefit from special tax rates or reductions.

- Before Departure: If leaving Korea, you must file your income tax before your departure date.

Your 2025 Korea Tax Filing Checklist

Frequently Asked Questions ❓

I hope this guide has made your foreigner Korea tax filing journey a little clearer and less daunting! Remember, staying informed and filing on time is the best way to avoid any trouble. If you have more questions, please feel free to ask in the comments below~ 😊