Closing Your IRP Account in Korea: A Simple Guide

📋 Table of Contents

- 1.Understanding Your IRP Account in Korea: What is it?

- 2.Reasons and Considerations for Closing Your IRP Account

- 3.A Step-by-Step Guide to the IRP Account Closure Process

- 4.Essential Documents for Closing Your IRP Account

- 5.Taxes and Fees When Closing Your IRP Account

- 6.Receiving Your Funds After IRP Account Closure

- 7.Important Precautions Before Closing Your IRP Account

- 8.Frequently Asked Questions About IRP Account Closure

Have you been thinking about how to close your IRP account in Korea? Maybe you’re moving away, changing jobs, or simply reaching retirement age. It can feel a bit overwhelming, but don’t worry, I’ve got you covered! 😊 I’ll walk you through everything you need to know to make the process as smooth as possible.

Closing an IRP account involves a few steps and important considerations, especially regarding taxes. So, let’s dive in and understand how to navigate this process with ease!

Understanding Your IRP Account in Korea: What is it?

People reviewing IRP financial documents.

First off, what exactly is an IRP (Individual Retirement Pension) account? It’s a special type of pension account in Korea designed for workers, self-employed individuals, and freelancers to save for their retirement. It’s a great way to secure your financial future!

One of the biggest perks of an IRP account is the tax credit benefits you can receive, up to 9 million KRW annually. This means you could get some of the money you pay in taxes back! You can also invest in various financial products like deposits, funds, ETFs, and REITs through your IRP. To learn more about IRP tax savings, check out this article on IBK’s IRP Tax Savings.

IRP Account Quick Facts 📝

- Who can join: Anyone with income – employees, self-employed, freelancers.

- Benefits: Annual tax credit up to 9 million KRW.

- Investment options: Diverse choices like deposits, funds, ETFs, REITs.

- When to withdraw: From age 55, as a pension or lump sum.

Reasons and Considerations for Closing Your IRP Account

Person considering reasons for IRP closure.

People decide to close their IRP accounts for various reasons. Common ones include retirement, changing jobs, moving overseas, or simply reaching the age to start receiving their pension. It’s a big decision, so it’s good to understand the implications.

One crucial thing to remember is the potential downsides of early termination. If you close your IRP before you’re 55 or within 5 years of opening it, you might have to pay back some of the tax benefits you received. This usually means a 16.5% other income tax on the amount you received tax credits for. However, if you meet the requirements (age 55 or older, and 5 years or more of pension contributions), you can close it without these tax penalties. To understand more about potential tax refunds, you can check out this article on saving for retirement and tax refunds.

Closing your IRP account before age 55 or less than 5 years after opening could mean you lose your tax benefits and pay extra taxes. Always double-check the conditions!

A Step-by-Step Guide to the IRP Account Closure Process

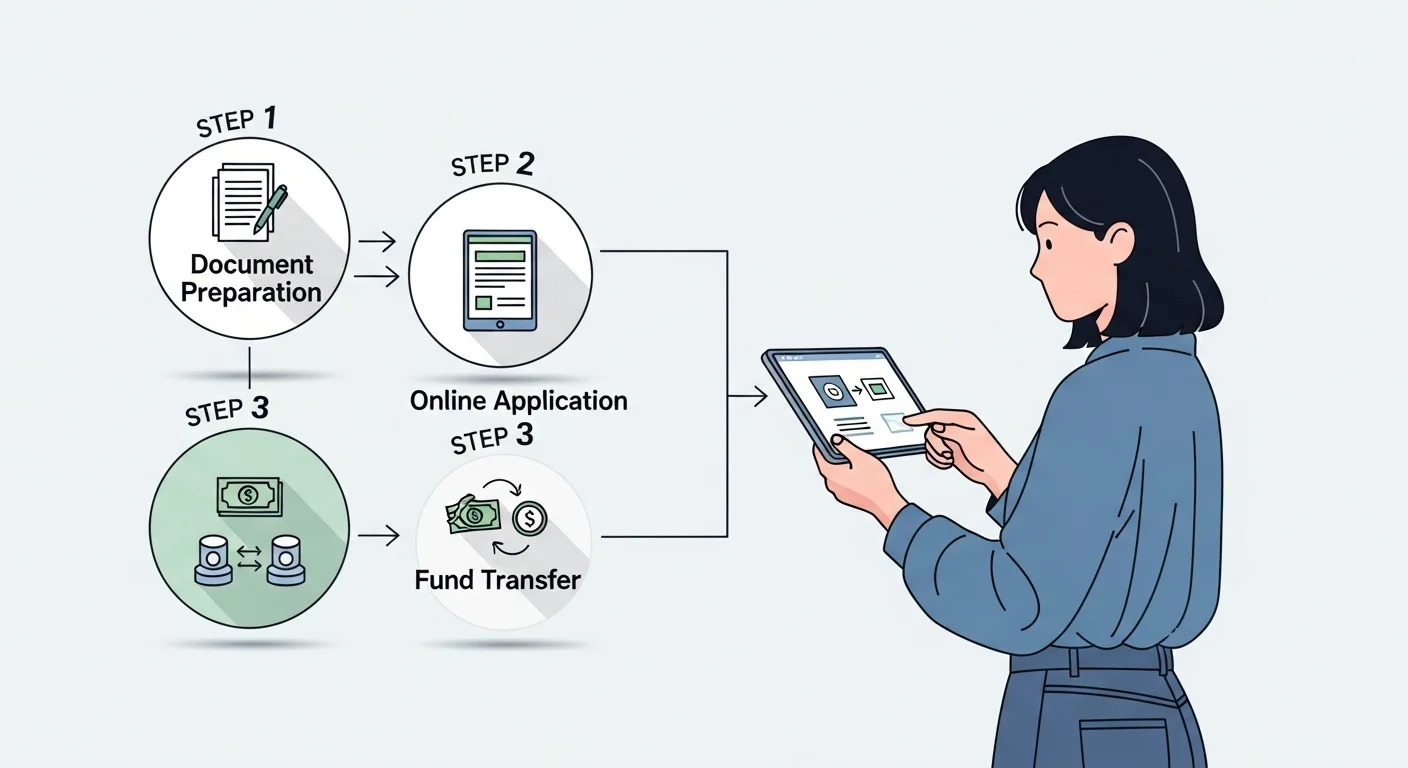

IRP account closure steps on a tablet.

Ready to close your IRP account? Here’s a general overview of the steps involved. It’s usually a straightforward process, whether you visit your bank or do it online.

- Step 1: Decide and Prepare. Make the decision to close your account and gather necessary documents like your ID and bank passbook.

- Step 2: Apply. Visit the financial institution where you opened the IRP (bank, securities firm) or apply non-face-to-face via their mobile app or internet banking. Many banks like Woori Bank offer online services, which you can explore on their IRP Login page.

- Step 3: Confirm Details. The institution will verify your reason for closure and inform you of any tax implications.

- Step 4: Receive Funds. Your funds will be transferred to your designated bank account.

Remember, if you’re currently overseas, you must close your IRP account while in Korea. You cannot do it from abroad, so plan ahead if you’re leaving Korea!

Essential Documents for Closing Your IRP Account

Gathering the right documents is key to a smooth IRP account closure. Here’s what you’ll typically need to have on hand. It’s always best to check with your specific financial institution, as requirements can sometimes vary slightly.

Required Documents 📄

- Your identification card (resident registration card, driver’s license, passport, etc.).

- Your IRP account passbook or account number.

- A certificate of retirement (if closing due to retirement).

- A certificate of overseas relocation (if closing due to moving abroad).

- Any other additional documents requested by your financial institution.

- For non-face-to-face closure: a public or joint certificate and your mobile phone under your name are often required.

Make sure you have all these documents ready before starting the process. For those preparing to leave Korea, it’s a good idea to check out this guide on things to check before you leave Korea, which might offer further tips.

Taxes and Fees When Closing Your IRP Account

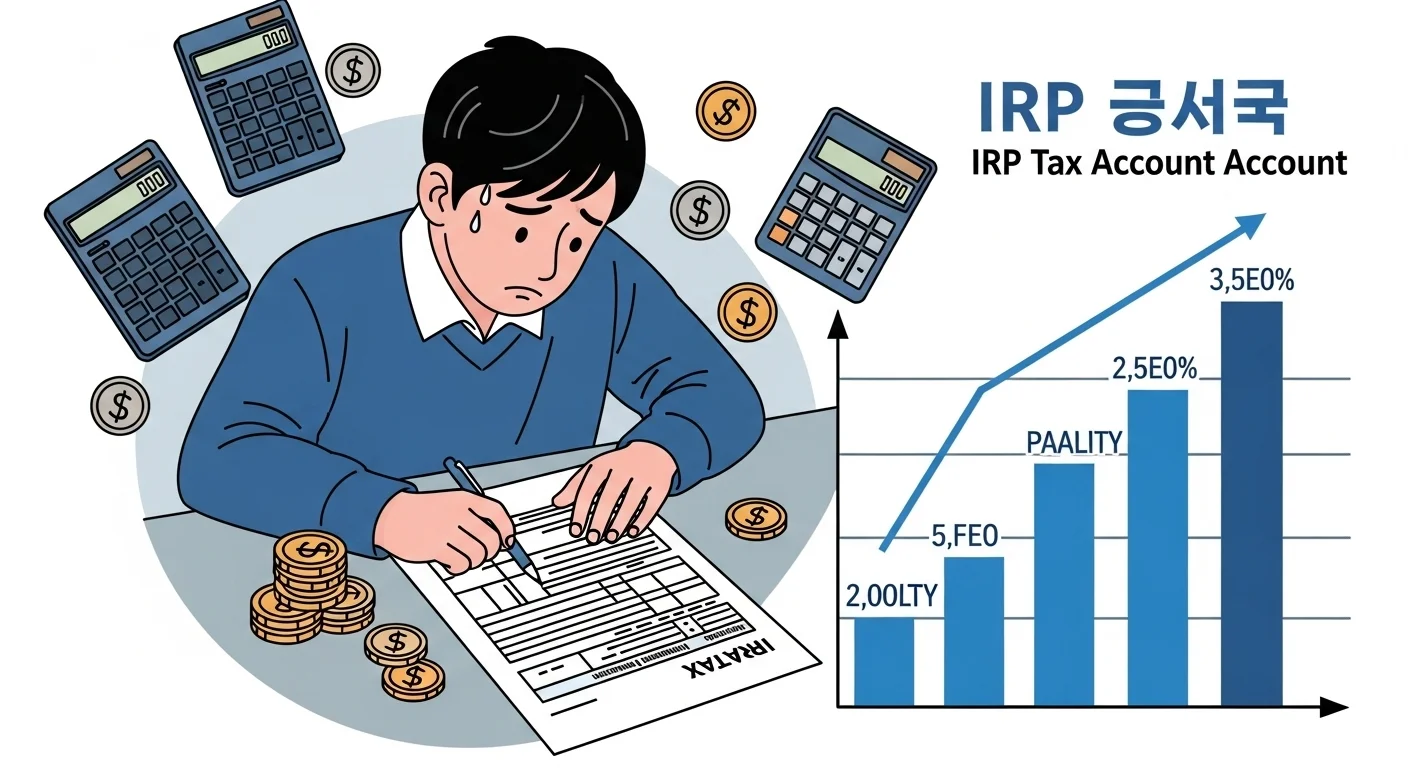

Person concerned about IRP withdrawal taxes.

Understanding the tax implications is super important when you close your IRP account. It can save you a lot of unexpected costs!

- Met Pension Requirements: If you are 55 or older and have contributed for 5 years or more, you’ll get a tax reduction on your retirement income tax (typically 3.3% to 5.5%).

- Early Termination: If you don’t meet the conditions, you’ll be subject to a 16.5% other income tax on the amount for which you received tax credits.

- Termination Fees: Many financial institutions don’t charge a direct termination fee for IRP accounts. However, if you had investments within your IRP, there might be separate fees for selling those investment products.

- Pension Withdrawal Perks: Some financial institutions even offer benefits like a 50% reduction in management fees if you receive your funds as a pension. For more information on general retirement plans, you can refer to resources like Retirement Plans from Easy Law.

Always verify the exact tax rates and any potential fees with your financial institution before proceeding.

Receiving Your Funds After IRP Account Closure

Once your IRP account is successfully closed, the next step is getting your money! It’s usually a simple process, but there are a few things to keep in mind.

How to Get Your IRP Funds 💰

- Domestic Bank Transfer: Most financial institutions will transfer the closure amount directly to a domestic bank account under your name. This is the most common method.

- Overseas Transfer (Limited): For overseas residents, some banks might support transfers to an overseas account, though this can incur additional fees. However, as noted before, you typically need to be in Korea to initiate the closure. If you’re a foreigner seeking a lump-sum refund, the National Pension Service also has related information.

- No Cash Withdrawal: You generally cannot receive your funds in cash; transfers to a bank account are the standard.

Make sure the bank account you provide for the transfer is accurate and in your name to avoid any delays.

Important Precautions Before Closing Your IRP Account

Before you finalize your IRP account closure, there are a few critical points you absolutely must consider. Paying attention to these can save you from future headaches and financial disadvantages.

- Overseas Stay: You MUST close your IRP account while in Korea. It’s impossible to do it from abroad. So, if you’re planning an exit strategy from Korea, handle this before you depart!

- Tax Disadvantages: Always confirm any potential tax penalties or disadvantages based on your specific closure reason before proceeding.

- Pension Conditions: To maximize your benefits and minimize taxes, it’s highly recommended to meet the pension receipt conditions (age 55 or older, and 5 years or more of contributions).

- Integrated Tax Credit Limit: Your IRP and Pension Savings (Yeongeumjeochuk) accounts share a combined tax credit limit. Make sure to check your overall tax credit history before closing to understand the full impact.

Taking these precautions will help ensure you make the most informed decision about your IRP account.

Frequently Asked Questions About IRP Account Closure ❓

📚 Recommended Reads

IRP Account Closure Key Takeaways 📝

Let’s quickly recap the most important things to remember about closing your IRP account in Korea:

IRP Account Closure Key Takeaways

Closing an IRP account in Korea might seem complicated, but by understanding the process, required documents, and tax implications, you can handle it smoothly. I hope this guide helps you navigate your IRP journey with confidence! If you have any more questions, feel free to ask in the comments below. 😊